If you plan to buy or sell a house this year, you need to study the real estate housing market and understand its trends to get the best deal. A real estate market comprises many people looking to sell and buy.

The market has seen a lot of ups and down all over the country. However, the most significant factor that affects it is the economy. North Carolina is a popular location to buy your dream home, having a plethora of history, culture, and tourist spots.

To understand the housing market in North Carolina and its states, such as the trend in Holly Ridge Real Estate, you will need to look at the factors that determine market uprise or crash.

When making forecasts for the current year, experts suggest that the market will be slow due to the economic downturn compared to previous years. However, different paces of the market benefit people differently. So, read on to find the intricacies of the North Carolina housing market.

Factors Affecting North Carolina Real Estate Market

The following factors affect the prices of the North Carolina real estate market:

1. Mortgage Interest Rate

The interest rates of the real estate market in North Carolina significantly affect the number of buyers. Increasing continuously, the interest rates have decreased the real estate demand due to high prices.

2. Economy

The economy of any housing market depends on various economic factors such as the GDP, sales prices, employment, manufacturing rate, and other factors that affect the country’s economy.

3. Demographics

The demographics of any country, such as the population, age of people, gender, income rates, and growth, determine the demand for the type of real estate property.

4. Government Policies

Government factors such as tax, subsidiaries, and deductions significantly impact real estate demand. This can help determine the demand and supply in the market.

Real Estate Market Statistics For North Carolina

A brief overview and market predictions suggest a slower real estate market in 2024. The following statistics have been observed for North Carolina:

- With high-interest rates, market sales have slowed down. As of December 2022, $329,634 was the average market value of the real estate in North Carolina, a 15.7% increase.

- As of December 2022, the number of homes for sale was down by 5.4% year over year, wherein only 7,125 new homes were listed.

- Houses sold was down by 27.8% year over year.

- Only 10,998 homes were sold in December 2022, less by 15,000+ units than the previous year.

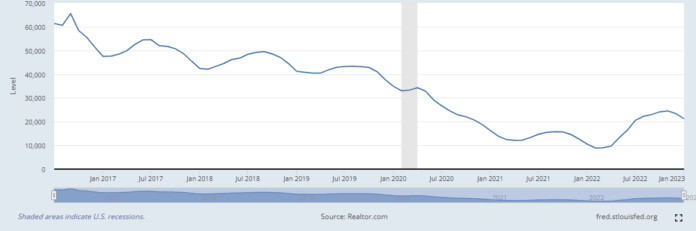

Source: realtor.com - About 23.3% of properties saw a price drop, compared to 16.4% last year.

- There has been an increase in the rent price as well, affecting tenants as well. On average, the rent is more by $50 monthly.

- The median sale price increased by 10.1%.

- The mortgage rates are high, increasing by 7.08% year over year.

Prediction For North Carolina Housing Market

The North Carolina housing market predictions for 2024 show the formation of a housing bubble due to the high mortgage, inflated prices, and a low number of properties for sale. While it is not expected to crash, the market is at a slow pace.

Mortgage Interest Rates

Experts predict an increase in mortgage rates due to inflation and recession. As a result, the target Fed funds rate may go up to 200 basis points from current levels, increasing the 15 and 30-year mortgage rates significantly. However, inflation might remain the same if inflation is controlled.

However, looking at the current trends, the mortgage rates have decreased since November 2022 and are expected to lower in the latter half of the year. So while they may not fall significantly, there will be a figure change.

Home Sales

With an increase in mortgages, housing sales are bound to go down. The interest rates could cause a 10% drop in sales in 2024, keeping the inventory steady.

Experts predict that sales will continue to lower at the beginning of the year and may increase in the latter half.

Home Prices

While some experts say low inventory will not cause a price drop, others predict lower selling rates due to higher interest rates and low affordability. However, it is ensured that there will not be a double-digit price increase, such as in the pandemic.

Housing Inventory

The market trends suggest that the housing inventory will remain the same since only a few people will consider selling their property at low rates in the inflated market. However, those who decide against lowering their prices just for selling might put up their properties due to the high demand.

According to NAR, inventory increased by 23% in 2024 due to low sales and high prices. However, the list will not be as expanded as it was during the pandemic.

Real Estate Affordability

Since there are no new houses on the market, affordability is likely to stay the same since sellers may lower the price with an increase in the interest rates.

While the market was deemed hot in 2022, a standard prediction cannot be made for all metros for 2024.

There is bound to be a variation in demands all over the state, bringing in significant variability.

Housing Market Bubble

Predictions confirm a bubble trend in the housing market due to a high price increase. With a limited inventory, the supply will be tight, creating a housing market bubble as buyers and investors pool in.

While the North Carolina housing market is in a bubble, the market is unlikely to crash soon. It is best to wait out in such a market unless you want to downsize, relocate, or rent. Because while the market is great for sellers, you will need more time to buy a new real estate property with competitive prices.

Conclusion

The North Carolina market has been a hot real estate housing market since the pandemic but is going the other way as of 2024. While the prices may fall, there is no increase in inventory, making the market tight.

In 2024, North Carolina is still a top-ranked relocation destination; therefore, there will be an influx of prospective buyers, decreasing inventory, and increasing prices.

However, since no one prediction can be made for all the metros, it is best to study the trends of the area you are planning to buy or sell in before entering the bubble market. The market currently favors sellers.