A payroll service provider (PSP) streamlines tasks like processing payroll and tax filing and handling deposits and withdrawals. Some providers also offer additional human resources and benefits management services.

Consider how often your firm processes payroll. Also, if your staff has hourly or seasonal fluctuations, look for a solution that breaks down data by year, month, week, day, or hour.

Employee Self-Service

Employee Self-Service (ESS) is the feature available in many HR solutions that allow employees to access their documents and information without contacting HR. This will enable employees to complete tasks like submitting time off requests and checking salary information, reducing HR bottlenecks and improving efficiency.

HR departments often get bogged down in routine administrative work, such as processing payroll, distributing paychecks, and fielding questions from current and former employees about compensation and benefits issues.

Fortunately, your business has an all-in-one payroll and HR service provider platform. In that case, most of these processes can be handled through an ESS portal, meaning your employees only need one system to manage their data.

Typically, these platforms allow employees to log into their accounts with a username and password. From there, they can see their personal information, including their paycheck stubs and tax withholding information.

Additionally, they can view their schedules, submit requests for time off, and pick up shifts if needed, all without involving the HR department.

Employees can also view their performance reviews, company-wide policies, and training materials through a single interface. The most advanced HR software systems even include internal knowledge bases, allowing employees to find answers to any queries they might have without having to wait for someone to research and provide them with a response.

Employee Information Verification

Employment verification can help ensure accurate information about an employee’s past work experience and qualifications. It can also help mitigate the risk of fraudulent credentials.

However, some laws limit how much and what type of information can be released for employment verification purposes. It’s essential to familiarize yourself with these laws, especially when working with third-party service providers conducting this research type.

For example, many states restrict what information employers can disclose about salary history.

Some state laws also prohibit releasing such information to people who don’t have the right to receive it. In addition, many companies have internal restrictions on what can be verified and to whom it can be disclosed.

Using an advanced payroll services provider can reduce the time and effort HR staff must spend verifying information, freeing them up to focus on other critical tasks. It can also help ensure that all employment verifications are handled in compliance with federal and state laws.

When using an E-Verify enrolled service provider, ensure that the program administrators are well-versed in the rules and responsibilities of the program. They should be able to answer questions and assist with troubleshooting.

E-Verify enables employers to confirm new hires’ eligibility for employment by electronically matching their information on Form I-9 against records from the Social Security Administration and Department of Homeland Security.

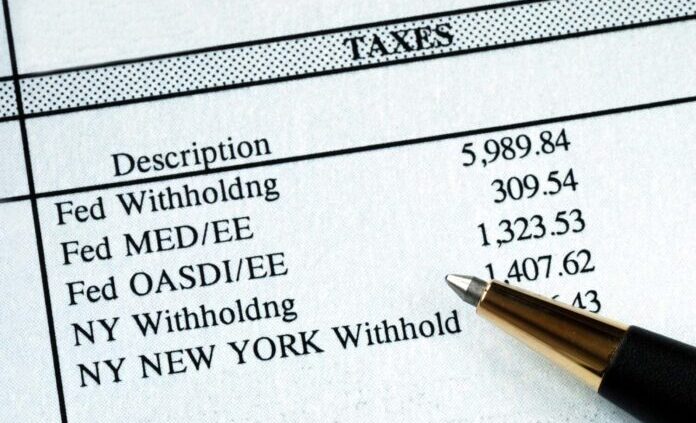

Tax Withholding

The IRS requires employers to withhold tax from employees’ paychecks and remit it to the federal, state, and local governments. This includes taxes for wages, unemployment, and disability insurance.

It also applies to non-wage payments such as dividends and interest in certain situations. In addition, employers must keep track of withholding amounts and report them on quarterly tax returns.

Many payroll service providers can handle tax withholding and filing on behalf of their clients. They may offer a single payroll processing module or a complete HR and benefits management tool suite.

For example, solving is an employer of record for businesses in more than 160 countries and helps them comply with international employment laws. It can also provide employee self-service through a portal for documentation, pay stubs, and other information.

Determining whether your prospective payroll provider integrates with other data platforms like accounting systems is essential. This can help reduce the number of steps in processes, eliminate duplicate data entry, and prevent manual errors.

In addition, consider whether you can contact them with questions through phone, email, or live chat. The company’s customer support hours should align with your business’s schedule and location.

Gusto’s easy-to-use online payroll software allows you to manage tax responsibilities for both W-2 and 1099 workers. Its cloud-based system offers direct deposit and new-hire reporting, and it can provide various HR services, such as free financial planning tools for employees.

Benefits Administration

While salary is a significant facet of employee compensation, a diverse and expansive benefits package shows your commitment to employees’ well-being and can give you a competitive edge.

However, implementing and managing your benefits program takes considerable knowledge, time, and effort. Often, the responsibilities for this fall to your HR team.

In addition to managing your company’s monetary and non-monetary employee benefits, this role involves enrolling employees in the programs, tracking their contributions, and ensuring they receive the entitled entitlements. In addition, your HR department must keep up with ERISA and COBRA regulations.

Rather than having your employees and HR staff re-enter data in two different systems, using one integrated system allows them to update information easily and quickly. It also reduces the risk of human error when changing confidential employee information and allows your payroll and HR teams to collaborate more closely.

Many independent benefits technology providers offer full-service employee benefit platforms as software-as-a-service (SaaS) products that can be integrated into your existing HR systems.

Some payroll service providers also provide these features, allowing you to manage your payroll and benefits simultaneously. This approach can be precious for small businesses needing an HR department. Many providers work with benefits brokers who can design custom systems for your organization.