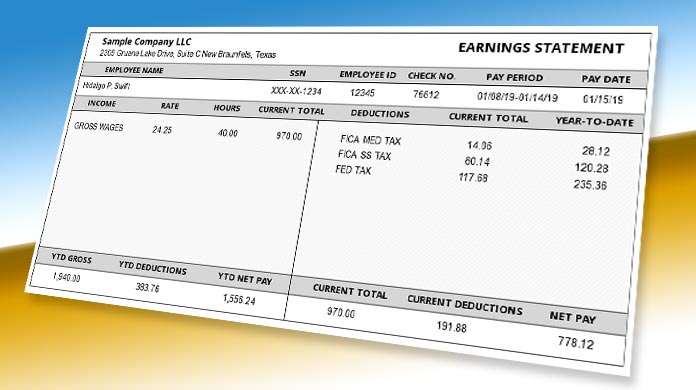

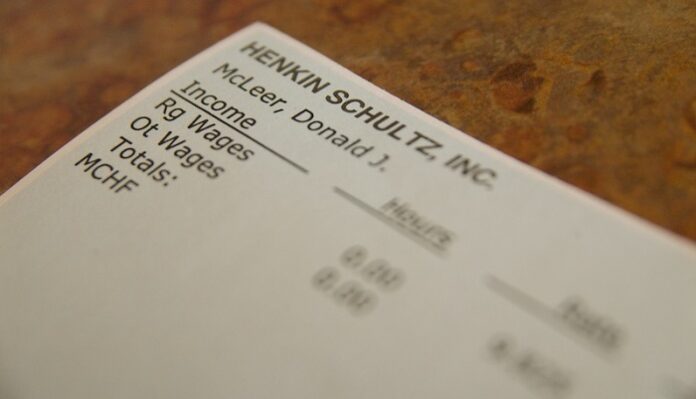

A pay stub is a piece of a paycheck or another document that is attached to the employee’s current pay list and also their YTD amount. If you offer physical checks to your workers, then this pay stub paper is attached to the paper check only. However, when you pay your workers through some electronic means, then the pay stub should be digital. Let us now have a look at all the things that every pay stub needs to include in it:

1. General information:

Pay stub must contain general information regarding both the employer and the employee. This general information includes the names, address, company name, and social security number. Such data is recorded by the company whenever the employee starts working with them from the first day.

2. Gross wages:

Gross wages are referred to as the total income earned by the employee before any state income tax, federal income tax, or other taxes are deducted from his salary. Calculating the gross wages is not very tough. If your employees work on an hourly basis, then you have to multiply the number of hours they worked during the pay period by their hourly rate to calculate their gross wages. For salaried employees, gross wages can be calculated by dividing their annual income by the number of pay periods in a year.

3. Employee taxes:

Gross wages are not what employees are supposed to take home. There are various taxes that reduce a worker’s salary. The paystubs must include the list of all the taxes that are deducted from the employee’s gross wages. The standard payroll taxes such as federal income tax, local income tax, state income tax, and other deductions related to health insurance and security are all mentioned in the pay stub.

4. Employer contributions:

If you are an employer, you have to make specific contributions on behalf of your workers. There are certain items on the employee’s check stub that must not be deducted from their gross wages. These are known as the contributions that you should make as an employer. The things in which an employer can contribute includes health savings accounts, health insurance premiums, and retirement plans.

5. Net pay:

Net pay is the amount of money left after deducting all the taxes from the gross wage of the employee. Net pay is the salary that the employee takes home. It is the salary paid by the employers to their workers after making all the deductions.

Do you need to provide pay stubs to your employees?

There are numerous states that require the employers to give check stubs to their workers. But it is not a compulsion in every state. Also, the information that you need to include in a pay stub varies from state to state. You can provide your employees either paper pay stubs or digital ones depending upon the method you use to pay them. Before taking any actions, we would suggest you study the rules and regulations of your state regarding the pay stubs.