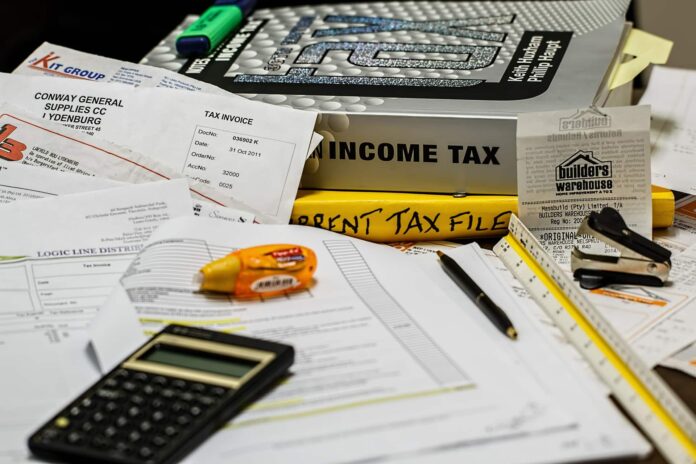

Spending some time understanding how Canadian taxes, such as the GST/HST, income tax, employee source deductions, and the Canada Pension Plan, may affect your company is a brilliant idea.

Collecting and submitting the tax

If the yearly income of your business is more than $30,000, you must register to be able to collect and send the GST/HST on sales of the relevant goods and services. If your company’s annual income is less than $30,000, you may voluntarily register to collect and remit the tax.

GST/HST registrants must meet several standards. The requirements include:

- Sending in returns on schedule.

- Collecting taxes.

- Sending in any unpaid net taxes.

Employee source deductions

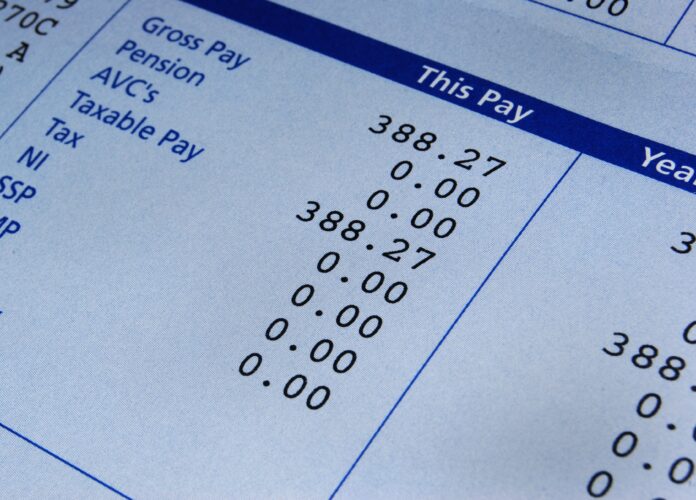

If you plan to hire an employee, you must pay your share of the CPP and EI payments and the income tax taken from your employees’ paychecks. Additionally, you will be liable for covering their CPP and Employment Insurance (EI) premiums.

Are Canadian start-ups subject to taxation?

You must register for the GST/HST if you provide taxable goods and services in Canada and your total taxable revenue exceeds $30,000 in any calendar quarter or four successive quarters. The website of the Canada Revenue Agency has further details.

Additionally, you could be required to deduct income taxes from your earnings. You must submit a tax return after your first year of operation to see how much, if any, tax you owe. There are different tax laws at the federal, provincial, and territorial levels. It is, without a doubt, advised that you work with a certified public accountant to prepare your yearly tax return. A corporate tax accountant can be of crucial importance when starting a business.

Income Tax For Businesses In Canada

Provide taxable products and services in Canada, and your total taxable proceeds reach $30,000 in any calendar quarter or four consecutive quarters. You must register for the GST/HST.

You may also need to pay income taxes from your profits. After your first year in business, you must file a tax return to determine how much, if any, tax you owe. Tax laws vary at the federal, provincial, and territorial levels. Working with a qualified corporate tax accountant to complete your annual tax return is unquestionably recommended.

Cost of Capital Deduction

No discussion of Canadian income tax and small enterprises would be complete without including capital cost allowance (CCA). Know how to maximize your capital cost allowance claim and how CCA is calculated.

Registering retirement savings plans

For small businesses organized as sole proprietorships or partnerships, the simplest method to reduce Canadian income tax deductions is to use Registered Retirement Savings Plans (RRSPs). Find out when to contribute to your RRSP for the most tax advantage and the RRSP contribution limits.

Scientific investigation and experimentation

Many small firms think that tax benefits for scientific research and experimental development (SR&ED) are exclusively available to larger or incorporated enterprises. However, the SR&ED Tax Credit Program may be available to your small business.

Employee gifts that are deductible from income in Canada

You should be aware of the limitations on gift-related tax deductions if you’re the company that offers gifts to your employees.